Q4 2020 & Year In Review

Rarely have investors had to deal with the dichotomy of good and bad news as they did in 2020. A one in every one hundred year pandemic will do that. The long-awaited news of two effective vaccines in November unleashed a flood of optimism in risk assets that led to a surge in equities in November and Q4; simultaneously, evidence of the Covid-19’s 3rd wave led to the grim news of daily records of virus cases, hospitalizations, and deaths, leaving hospital systems nearly overflowing at year-end. On the same day in December when Congress passed the heavily contested 5th pandemic stimulus package of nearly $900B that should provide near-term support to small business and consumers, the UK reported mutations of the virus had been discovered that leads to faster transmission, resulting in a near-complete travel ban in the UK. The list of similar dichotomies goes on, and includes second quarter GDP which fell a record 33%, only to see an equally historic recovery of 31% in the third quarter.2 It was the year that saw nearly 25m Americans unemployed at one stage (~15% unemployment), yet ended the year with consumer net worth at record highs, boosted by gains in the consumer’s two most important assets- stocks and housing, along with government transfer payments that supported income during the darkest days of high unemployment in the spring. The list of hard to predict outcomes is a long one, including a bear market that started on February 19th, ended on March 23rd, and where new highs were reached as early as September.2

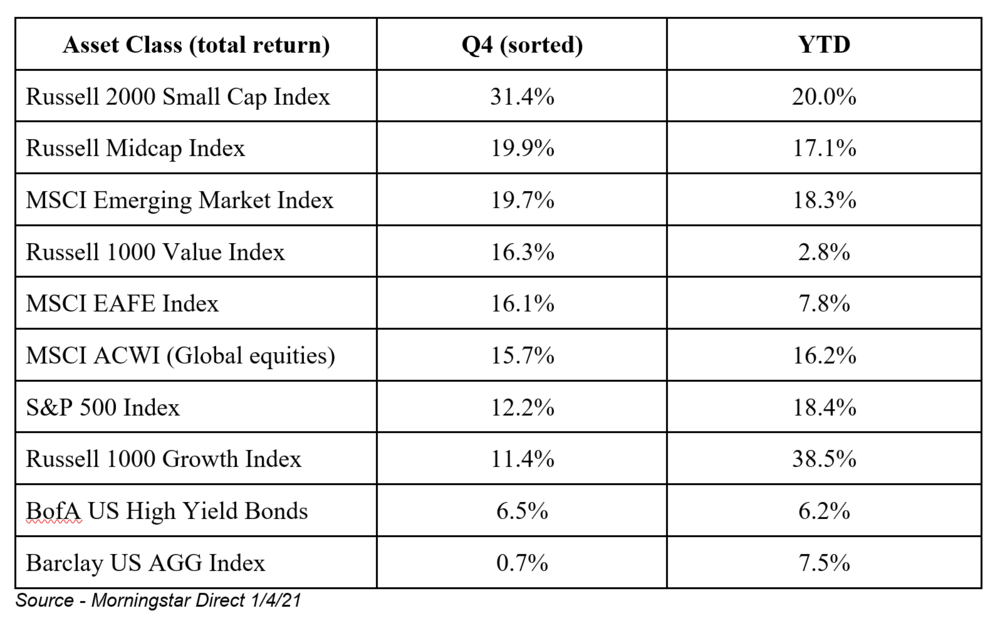

In the end, the influence of the Federal Reserve (and fiscal stimulus by Congress) carried the day, especially when the bitterly contested Presidential election was settled (without the expected “Blue Wave”) and successful vaccines were announced in November. Stimulus approaching 25% of the US GDP and cheap money overwhelmed concerns over deaths, earnings, business closings, and just about everything else. The acronym TINA, as in “Stocks, There Is No Alternative”, became the year’s narrative, as record-low interest rates left investors with little choice but to own stocks. A “K-shaped” economy emerged, with winning companies best able to navigate the stay-at-home lockdown, remote work and school were winners, while service industries, often employing lower-income workers, were negatively affected. With “free money” and a pledge by the Fed not to raise rates until 2023, it was a year to take risk, especially in Q4 after the vaccines were announced, when the instinct of most veteran investors was to preserve capital, given the economic and earnings demand. Where Fundamentum strategies lagged their benchmarks, it was largely explained by an approach that proved to be too conservative given the quick recovery and 4th quarter rally. As always, we place more emphasis over protecting the downside than in shooting for the best-case outcomes. That mindset hurt relative performance in 2020 in many strategies.

Things We Learned in 2020 (Or Were Reminded)

- The stock market isn’t the real economy

Much has been written about the disconnect between Main Street and Wall Street in 2020. It was hard for many to understand how so many stocks could do well when millions of people were unemployed and a great many companies closed, some permanently. With the success of the large Technology disruptors during the pandemic – Facebook, Apple, Microsoft, Google and Amazon – the value of these stocks rose to comprise nearly 25% of the S&P 500 Index during the year, making some sense of how “the market” could be up while the real economy was locked down for much of the year. At one point in September, these five stocks were up 65% for the year, while the remaining 495 stocks in the S&P 500 were only modestly positive.3 The 4th quarter rotation into value and small-cap stocks changed this dynamic where the breadth of returns ending up being broad, but this was the market narrative for much of the year. - The stock market discounts FUTURE expectations

Finance students are taught in Finance 101 in one form or another, the present value of any financial asset is the discounted value of FUTURE cash flows. The success of Zoom and Peloton during the pandemic is already embedded in their stock prices, and has little (if anything) to do with their future prospects. It’s what market participants expect to occur in the future, usually assumed to be in a 6-12 month period but often over a much longer period of time (Tesla’s embedded valuation is surely over a many year time horizon, not 2021) that determines the direction of a stock. As we were reminded in 2020, the future is unknown and hard to predict. Most analysts, us included, expect 2021 to be a year of strong economic and earnings growth which should support risk assets, as long as certain conditions persist. What is NOT expected in 2021-22, whatever that may be, will explain how risk assets perform in 2021. - Interest Rates matter (REALLY matter)

Discounting future cash flows when the real interest rate (10-year T-Bond yield less Inflation) is negative has a profound impact on how stocks are valued, especially long-duration growth stocks. While many worry that stocks are back to the bubble period of the dot.com era given high PE ratios today, others argue that relative to interest rates, stocks are not overvalued, and possibly attractively valued. With the Federal Reserve on record as saying they intend to hold the Fed Funds rate near zero as far out as 2023, and as they continue to pump in $120B monthly into the money supply through their purchases of Treasury and mortgage bonds, it’s easy to understand why investor confidence is so high. Signs of excess are easy to spot, whether it’s in the IPO market (where unprofitable companies like DoorDash and AirBnb rose 86% and 113% respectively on the first day of trading, and carry market caps of $45B and $88B and where more money has been raised in any year since the bubble period of 1999) or when considering margin debt, which reached a record $722b in borrowed funds at the end of November, often invested in by novice investors in options and risky leveraged ETFs.4 The Russell 2000 Small Cap Index sat 34% above its 200-day moving average on December 23rd, a record level so extended that it seems certain to result in a pullback at some stage.6 SPACS, BItcoin, Tesla are also examples of speculative behavior. Excessive enthusiasm and 1-way bets normally end badly, but the momentum can continue for longer than many expect. - Predictions made in January aren’t worth much!

Long-term investors will be well-served to monitor and confirm their asset allocation settings as those decisions will drive the bulk of the portfolio’s returns over time. Tactical investors (those trying to outpace the market averages in any given period) would be well-served to be open-minded to things that can’t be known in January. One prominent Wall Street analyst (which mirrored the consensus thinking a year ago), believed the S&P 500 Index could end 2020 around 3400 based on $178 in EPS. The Index ended up at 3756 on earnings that were only ~$135, as cheap money boosted valuations and stock prices.5 Things change and unforeseen occurrences happen, regularly. Some degree of humility and flexibility is needed to navigate events over the course of the year. Few would have predicted that small-cap stocks would be the leading asset class in the US in 2020, when as late as the end of October, the Russell 2000 Index was in the red for the year.

Questions For a Post-Pandemic World

- What is already discounted?

With record stimulus and massive pent-up demand from consumers that’s likely to be unleashed this year if the vaccines work as advertised (and enough people agree to be vaccinated), it’s not difficult to be bullish on the economy and corporate earnings in 2021. In fact, earnings estimates have been rising for 2021 with S&P 500 Index EPS now at $175, up from $165 a few months back, and relative to the $125 in EPS expected to be earned in 2020 as recently as August.2 2021 should be a year of “good news” for investors, certainly better than the news of 2020. The question is what is already discounted in stock prices? Stocks trading at 21x 2021 S&P 500 earnings is much higher than historical norms, but could be sustained depending on the answer to our next question, on inflation and interest rates. - Will inflation and interest rates remain so low?

This may be THE question that determines the outcome of 2021 in our view, a year when the economy and earnings are likely to be strong. Should long-term interest rates spike, from inflationary pressures or due to the strong economy, valuations for risk assets stand to be impacted. Of the 56 Wall Street economists polled in late December, only 4 believe the 10-year Treasury Bond will end 2021 above 1.50%, compared to the 0.98% rate today. Most (22) believe rates will be in the 1.25-1.50% range by year-end, a rise that, should it occur, isn’t likely to significantly damage valuations6. Nearly half the states in the US plan to raise the minimum wage rate in 2021 after 20 did in 2020, and many commodity prices have already surged given the strength in housing and in many Asian economies, which have recovered more quickly than the US or Eurozone economies. Global forces holding back inflation remain strong, but with $8B of stimulus enacted in 2020 from the Fed, BOJ and ECB, the same amount that was injected over EIGHT years following the Great Financial Crisis,5, some upward pressure on inflation and interest rates should be expected in 2021, but the magnitude of any increases will likely determine how the market performs. - What do we see in 2021?

In our view, risks are elevated and a day of reckoning is coming, but that day is unlikely to occur in 2021. Massive government and corporate debt, signs of investor speculation, and the abnormally high level of equity valuations normally end badly. However, our guess is the power of the reopening momentum, pent-up demand, and strong corporate profits are likely to generate another year of gains in US stocks. That’s not to say there won’t be pullbacks in stocks, there will be – that is normal and healthy. Over the past 40 years, a period where the S&P 500 Index has risen in 30 of those years, the average annual drawdown is 13%.7 At the risk of sounding like a broken record, the new year could also be one where non-US equities play catch-up to U.S. equities. Bonds may not act as a stabilizing force in 2021 given record-low yields and spreads, and an economy that will reopen with record stimulus. Still, our confidence in making predictions for any short-term period is low, including this one. We feel more confident in making long-term predictions (5-10 years) and here, given the starting point of high valuation for equities, historically-low interest rates, and inflation and tax rates that stand a good chance to rise at some point over the next decade (all likely to depress valuation multiples), we firmly believe long-term expectations for US equity returns are below historical norms. We encourage advisors to build lower capital market returns into their clients’ long-term financial plans. Traditional 60/40 stock/bond portfolios are unlikely to generate long-term returns as history would suggest. If you were bolder than we were in 2020, and were fortunate to have owned some of the more speculative securities out there, perhaps now is the time to “ring the cash register” as CNBC’s Jim Cramer likes to say.

We wish you the very best for a safe and prosperous New Year and as always, thank you for your faith in Fundamentum!

As always, we appreciate your confidence in our team.

Fundamentum Investment Committee

Robert Armagno, CFA® – Investment Committee

Paul Danes, CFA® – Investment Committee

Trevor Forbes – Investment Committee

Matt Dunn, CFA® – Chief Compliance Officer

References:

1 Morningstar Direct 1/4/21

2 Factset 1/4/21

3 Barron’s 1/4/21

4 WSJ 1/31/21

5 ISI 12/21/20

6 Strategas 12/28/20

7 JPMorgan Asset Management – Guide to the Markets

Investment advice offered through Fundamentum LLC a registered investment advisor. The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. There is no assurance that the investment objective of any investment strategy will be attained. Investing involves risk including loss of principal. Past performance is no guarantee of future performance. All indices are unmanaged and may not be invested into directly.