“First Derivative Improvement – Second Derivative Slowdown” 2020 Q3 Review & Outlook

The third quarter of 2020 was one when the US economy reopened and began a sharp recovery from the deep economic contraction of Q2 when Real GDP fell a record 31.4%,1 and when capital markets continued to rise on the backs of unprecedented levels of fiscal and monetary stimulus. It is clear that the US economy is on a path of improvement (WSJ economists predict a 24% jump in Q3 GDP) as the economy has partially recovered from the shortest recession in history, and that certain sectors of the economy (Housing) are even benefitting from partial stay-at-home conditions. It is also increasingly clear that heading into Q4, the pace of the recovery is slowing and with Covid-19 cases rising at quarter-end, much of the recovery is left squarely in the hands of the virus and what direction it takes. The case for a slowing recovery is most apparent in the labor market. The number of Americans unemployed, which started the year at 6.5m before spiking to 23m at its peak in April, has recovered to roughly 12m entering Q4 (7.9% unemployment, helped by a falling labor participation rate),1 a significant improvement. Still, the pace of monthly jobs added has slowed to 661k in September, compared to the prior four months when over 11m jobs were added.1 It is believed that 3.7m people are “permanently” unemployed, up from 2.0m in April as certain service-oriented businesses are permanently closed.1 This has led to what is being called a “K-shaped” economy, where the upward sloping arm reflects the housing and stay-at-home technology winners, and the downward sloping arm reflects much of the service industry, still decimated by the lack of demand in the travel, entertainment and restaurant industries. With Covid-19 cases rising as we approach the winter months where outdoor activities will largely be curtailed, confidence in the recovery is waning. The lack of another fiscal stimulus with Congress at an impasse is also a contributing factor to the sliding confidence around the recovery.

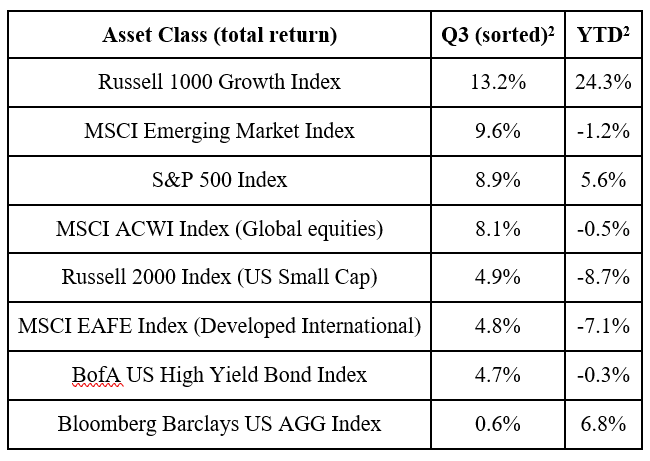

Risk assets continued to appreciate in Q3, with US stocks making new highs on September 2nd before succumbing to profit-taking through month end. This profit taking in September was especially true with Technology stocks which have been leaders all year and following signs of excess that occurred over the summer. Following the best quarter for the S&P 500 Index since 1998 in Q2,1 the S&P 500 Index rose another 8.9% in Q3 recovering all that was lost in the 35% collapse that occurred in Q1.1 This resulted in the best 2-quarter results since the recovery from the Great Recession in 2009.1 Speculative and fast-growing companies have been favorites of investors all year, as more stocks have risen at least 400% through the third quarter than since the “dotcom” period of 2000.1 This momentum-oriented trade has attracted a record $18B in funds that track momentum factors, triple the level of AUM in that factor only a year ago.1 While this momentum trade led to another quarter of large-cap growth leadership, participation was more broad in Q3 with Emerging Market stocks outpacing the S&P 500 Index, and with non-US Development Market and US small cap stocks at least participating in the rally, each up nearly 5%.

For the second consecutive quarter, bond yields were largely unchanged with the 10-year US Treasury Bond yield finishing at 0.65% this quarter compared to 0.67% three months ago.1 Any enthusiasm around an economic recovery that might have led to higher long-term interest rates is likely being offset by the Federal Reserve’s bond-buying program, keeping longer-term rates suppressed. Outside of the Russell 1000 Growth stocks so impacted by the technology sector, the YTD column in the chart above represents what most people feel is more reflective of the real economy. For example, the Russell 2000 Index of small companies is down nearly 9% in 2020, reflecting the hardship many small businesses have experienced with Covid-19 induced shutdowns.

Fundamentum strategies have largely participated in the stock market’s recovery, though generally remain on the conservative side with above-average levels of cash, a focus on domestic, large-cap equities, and with a distinct tilt toward quality in both equity and fixed income portfolios. We have been skeptical of the V-shape recovery argument, believing that while there will be a significant recovery from the government-induced recession, the ongoing battle against Covid-19 will leave the level of the economy below its potential throughout 2020, and likely through 2021 (aka an “output gap”). We believe equities have already discounted a great deal of the recovery that we envision, with the S&P 500 fully recovered for the year and with tech-heavy indices solidly positive for the year. With the S&P 500 trading at nearly 3400 at the time of this writing and EPS forecasts in the $125 range for 2020 and $165 for 2021, we see domestic equities as fully valued and are generally unwilling to bid up equities beyond the already high ~21x multiple on 2021 earnings. This is despite record-low interest rates and inflationary pressures that are surprisingly absent given the massive increase in the money supply. Beyond the tax loss harvesting and rebalancing that occurred in Q1, we have been suggesting and exhibiting patience with portfolio changes, making only modest changes to portfolios. We acknowledge investors seem willing to look past longer-term concerns that are growing, such as large government deficits, large increases in corporate debt, increasing leverage throughout the system, and increases in permanently closed businesses, and are instead responding to the beneficial aspects of the growing money supply, aggressive stimulus and expectations of a Coronavirus vaccine that most assume is inevitable. These factors along with the momentum of the reopening activity could drive equity prices higher in the remaining months of 2020.

However, two significant hurdles are present and are virtually impossible to handicap with any real confidence. With less than one month from the November 3rd elections, markets are likely to be choppy as investors react to polling data that can fluctuate, and as was learned in 2016, can ultimately be wrong. Clarity on the election, both its outcome and the orderly transition should President Trump not be reelected, seems necessary to us to move equities meaningfully higher. The second is the virus itself along with the degree to which the coming winter weather impacts the number of cases and limits reopening efforts. We have already witnessed examples of second shutdowns occurring in parts of Europe and the Middle East and talk of that in certain segments of New York City. Should that occur on a more wide-spread basis in the US, market gains seem likely to be limited. With money supply growing at a 25% rate in 2020,1 our belief in the “Don’t Fight the Fed” mantra has only strengthened throughout 2020, so risks seem manageable. Still, our confidence in making predictions is low for any short-term period, especially this one. We feel more confident in making longer-term predictions (10+ years) and here, given the starting point of high valuation for equities, historically-low interest rates, and inflation and tax rates that stand a good chance to rise at some point over the next decade (likely depressing valuation multiples), we firmly believe long-term expectations for US equity returns are below historical norms. We encourage advisors to build lower capital market returns into their clients’ long-term financial plans.

As always, we appreciate your confidence in our team.

Fundamentum Investment Committee

Chad Roope, CFA® Chief Investment Officer

Paul Danes, CFA® – Investment Committee

Trevor Forbes – Investment Committee

Matt Dunn, CFA® – OSJ Supervisor

References:

- Factset 10/8/20

- Morningstar Direct 10/8/20

Investment advice offered through Fundamentum LLC a registered investment advisor. The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. There is no assurance that the investment objective of any investment strategy will be attained. Investing involves risk including loss of principal. Past performance is no guarantee of future performance. All indices are unmanaged and may not be invested into directly.