As Chief Investment Officer, I thought it would be appropriate to give you my

latest thoughts on the markets (outside of the rigid quarterly update) as we begin

a re-opening phase now that the Pandemic of 2020/21 is subsiding in the U.S.

In many ways, as investors, we find ourselves sympathizing with Rip Van Winkle’s sense of bewilderment upon his waking after 20 years and finding that the American Revolution had been won. A sense of delusion in a world where everything has changed seems to have washed over society. Though the American Revolution is no longer an issue, our current world is one where valuations on Equities and Fixed Income are difficult to explain based on historical valuations. Helicopter money has become the norm via stimulus checks, or “stimmies” as the kids are calling them, and new asset classes are gaining mainstream momentum in the forms of Cryptocurrencies and Non-Fungible Tokens (NFTs). In our 2020 Reflection and 2021 Outlook, we mentioned stocks we can weigh. Fast forwarding 3 months later, the ones we can weigh look heavy, with indices across the board at or near all-time highs and those that we can’t reasonably weigh by our Free Cash Flow methodology, look even more expensive.

Ultimately, we cannot control market valuations and instead focus on controlling risk and taxes to the best of our abilities as we invest in financial markets on behalf of clients.

How do we look now?

As the first quarter of 2021 has closed and the new administration has settled in, it is clear that The Federal Reserve and Treasury Department are beating the same drums of “lower for longer” with respect to rates and why not? Inflation is low (I’ll get into this), stocks (or “stonks” to the kids) are going to the moon (via “diamond hands”), and the economy is opening up. The amount of cash being injected into the system has reflated Stocks, Bonds and Real Estate to all-time highs with The Fed purchasing $80 billion per month of Short-Term Treasuries and $40 billion per month

in Mortgages with no end in sight. Investment dollars are so starved for opportunities that big money (likely looking at valuations) is flowing into Cryptocurrencies as well as newly in vogue Non-Fungible-Tokens (NTFs). We’ve gotten to the point where a .jpeg image that anyone can download for free on the internet is worth $69 million. In fact, we are attaching that particular

.jpeg to this outlook for you to add to your investment portfolio at a $69 million discount. You’re welcome for the value-added service!

Investment Deck Realizations

As we look at the cards we hold, we find ourselves in what is a unique confluence of valuation and expectations. As investors, “we are all part of the same compost heap” as Tyler Durden in the movie Fight Club so eloquently put it from a fundamental investor’s perspective and that heap is one where investors are coming to a few key realizations:

1. Fixed Income returns will likely be muted versus the past 40 years of relatively consistent gains as rates have bottomed at zero and The Fed remains wary of negative rates. It is simple math, if you are not willing to cut to negative rates, bond prices will not rise to point where we have negative yields.

2. Future Equity returns are priced to require earnings filling some very large shoes from an expected growth rate standpoint but look

more attractive than bonds. As a result, the way we invest for clients over the next 1, 5 and 10 years will likely be very different from an asset allocation perspective if we are to help clients meet their long-term goals from a wealth perspective.

Regardless of the markets, we remain steadfast in our direction at GA Investment Management of controlling to the best of our abilities the two most important pieces of our clients’ long-term wealth glidepath: Risk and Taxes.

We are not calling Chicken Little just yet though:

I can assure you that it is not all doom and gloom in the financial markets! While we collectively gawk in bewilderment at the resiliency of companies and stocks in general to the pandemic shutdowns, it is clear that financial liquidity is not a concern as of this writing and that countries around the world are increasing vaccinations at ever higher rates. Economic data is demonstrating solid upside momentum and, albeit anecdotal, Mikey and Big Bob on 96.1 said that traffic in the mornings is now regularly backing up to the top of Greentree Hill; something that has not happened in nearly a year during morning rush hour! On that slightly positive note, we’ll recap what has happened year to date for those of us who have been Rip Van Winkled for the past 3 months.

Year to Date as of close 5/10/21 Quick Recap:

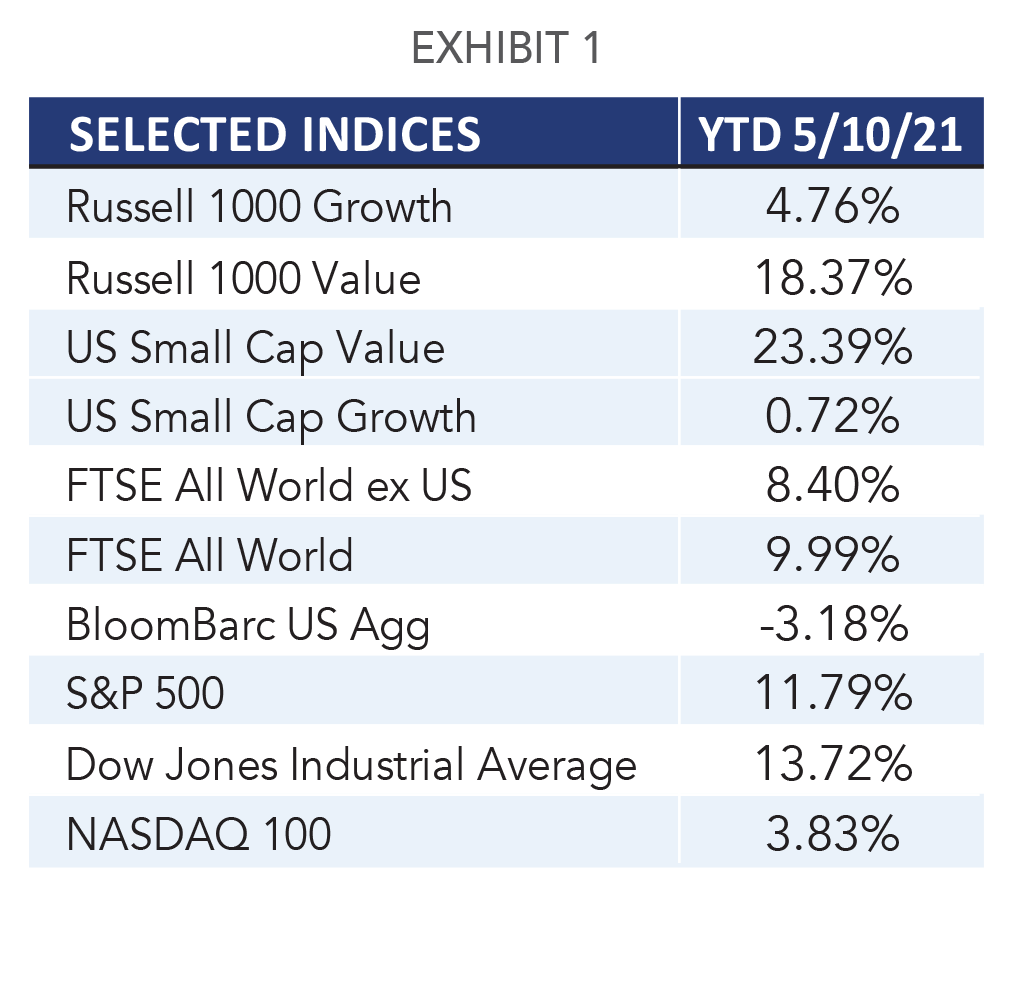

It was an incredible quarter to start 2021! We are clearly over the river and through the woods, but does anyone really know where Grandma’s House is? Below you can see market returns have provided mixed but strong returns for just one quarter’s worth of work with Small Cap Value powering ahead.

Returns are via www.finviz.com and are based on investable ETFs. Returns include dividends.

Primary Observations:

1. Value outperformed Growth in both Large and Small Caps with respect to US Indices.

2. US Fixed Income underperformed Equities across the board.

3. International Equities underperformed US Equities.

What is still left to be decided on the way to Grandmothers?

1. How bifurcated are internal economies going to be? Does the “K” shape recovery persist? I think the K-Shape does, but are new Democrat policies going to shift this tide of arguably the past 20 years where the top 1% take most of the spoils by owning the productive assets?

2. How far behind will countries be that are not vaccinating as fast as other countries and what are the repercussions? Brazil in particular seems to be having a difficult time with total deaths approaching that of the United States’. India, a much larger economy, is also struggling to emerge from the Pandemic with cases spiking in recent weeks. Will they ultimately be left behind as other developing and developed economies open?

3. How long can governments around the world and in the United States suffocate Interest Rates before “the market” says enough is enough, demanding a real rate of return after adjusting for inflation? We think that money is moving into Precious Metals in addition to Collectibles, Cryptocurrencies, and NFTs (in order of least to most risky by our perceptions) as a hedge against government money supply increases and that this will continue until a real rate of return comes back to the sovereign fixed income space.

4. Do Equity Valuations or Debt Valuations revert towards historicals first? The classic chicken or the egg scenario is in play here. Do interest rates rise first, sparking an equity sell off as there becomes a bond alternative to invest in or do Equity multiples fall back towards historical averages? In our opinion we think the former would be the more likely scenario and within that scenario, the speed with which rates rise will be of most concern. One element that is clear though is that the 10-year US Treasury rising from .91% to 1.75% in the 1st quarter did not ultimately result in lower equity prices as we make new highs in the market across the Dow 30, NASDAQ 100 and S&P 500.

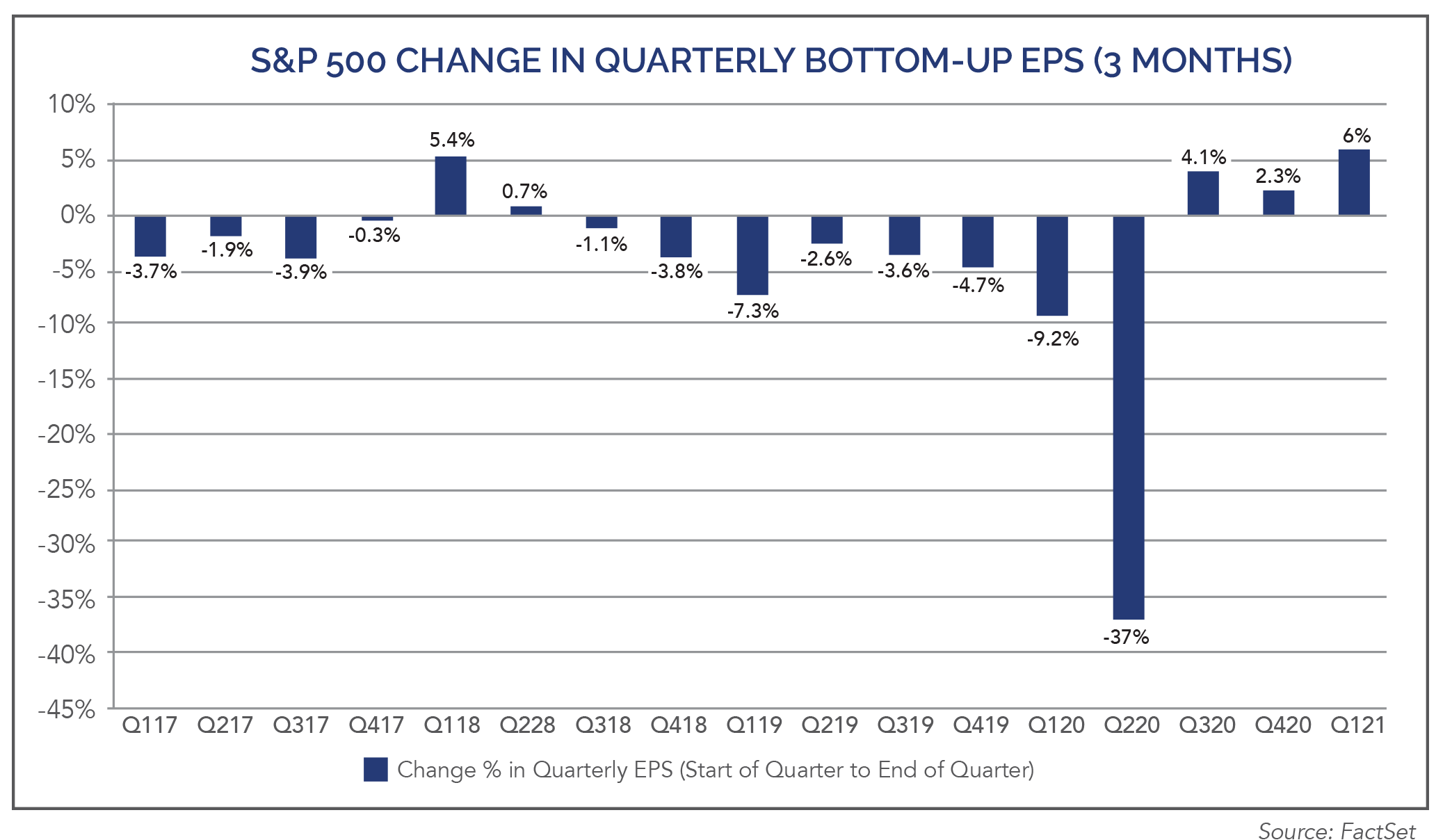

a. The S&P 500 has some big shoes to fill in terms of earnings to justify valuations; even with interest rates as low as they are in our opinion. For example, the S&P 500 opened the year at 3,764.61 with the 10 yr. Treasury yielding .91%. Fast forward to 5/10/21 and the S&P 500 is now 11.79% higher and the 10 yr. Treasury is yielding 1.6%! Stocks are undoubtedly more expensive now than at the start of the year despite earnings expectations rising on the S&P 500 by a whopping 6.0%. Below is the change in earnings expectations during the quarter and you can see this is the biggest change in EPS estimates since at least 2017.

b. Fixed Income has made a move in the right direction towards a functional rate, but we are still a long way off from where we should be in our opinion. Theoretically, the risk-free rate should provide to the investor no gain or loss in their purchasing power over the investment period. The US Consumer Price Index (an arguably imperfect measure of inflation) is projected to be approximately 2.2% for 2021. In theory, the 1-year rate on a Treasury should therefore be 2.2% (it sits at .06%). To get 2.2% on your money in US Treasuries you need to go all the way out to the year 2040 maturities! Unsurprisingly, we continue to be underweight US Treasuries vs. the Barclays Aggregate Bond Index. I do not expect to get anywhere near the rates justified but think there is still room to move lower from a price standpoint.

First Quarter of 2021 Positioning Recommendations and Outcomes

As investors, we are constantly looking forward for where our dollars are best allocated. We also need to save time for reflection to learn from our mistakes and hopefully improve in the future. So how has our positioning for client portfolios played out in Q1 of 2021?

A refresher on what I said in our initial market outlook.

In Brief:

1. Equities to outperform Fixed Income.

2. Value over Growth.

3. Small over Large (in the short run).

4. Short Duration over Long.

5. Anything over Cash.

Portfolio positioning benefited from our thoughts on 1 through 4 while cash was not the biggest loser.

1. As we can see from Exhibit 1, the FTSE All World Equity Index was up 9.99% while the BoomBarc US Agg was down 3.18% for the first quarter.

2. Large Cap Value outperformed Large Cap Growth to the tune of 18.37% vs. 4.76%which I will get into more detail below.

3. Small Caps were a bit of mixed bag to say the least and had a large dispersion in returns with Value returning 23.39% and Growth returning 0.72%. In our ETF portfolios, we were neutral from both a size and style perspective and are considering a small cap growth position overweight as a re-opening success play.

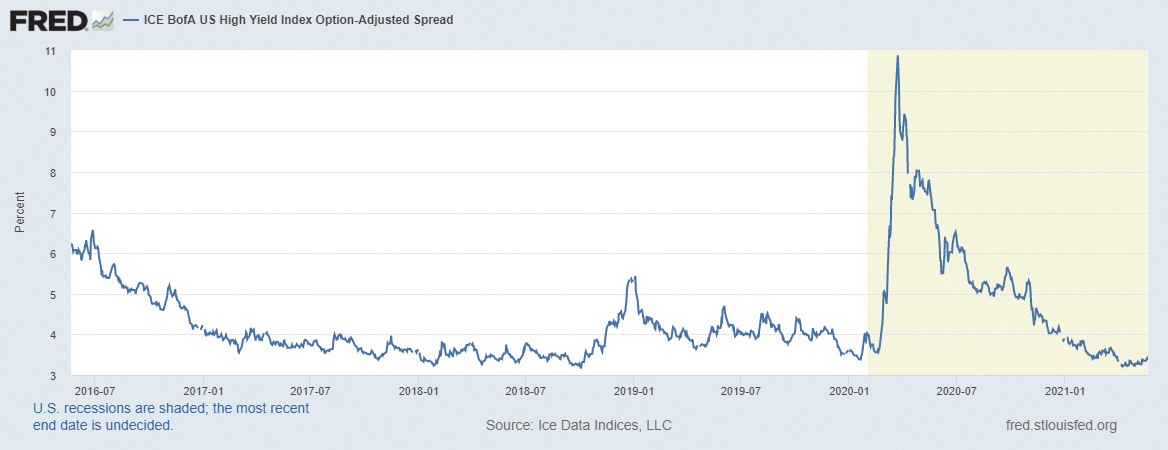

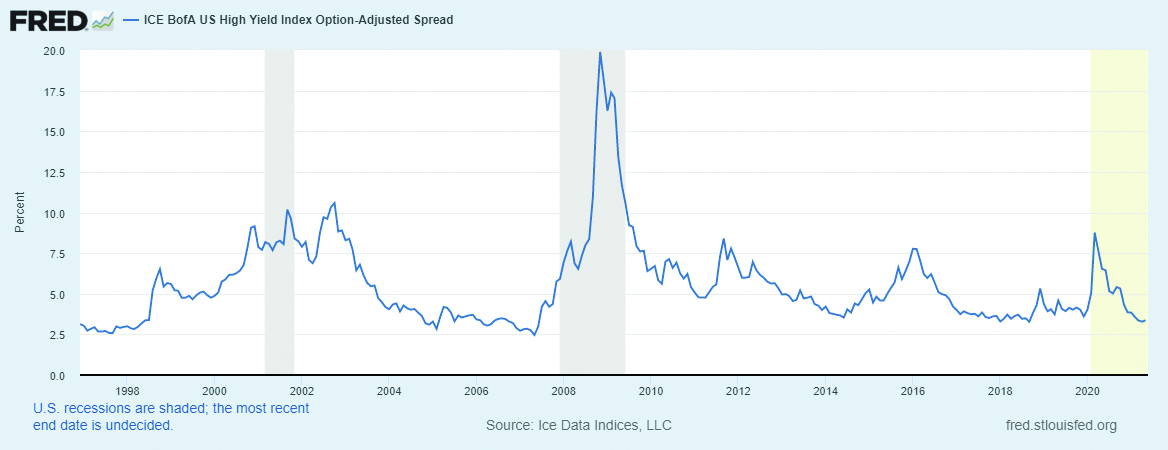

4. Short duration over long was beneficial to our Fixed Income positioning with the 10 Year US Treasury rising from .91% up to 1.75% at the peak. Corporate Yields also rose but the spread between Investment Grade and High Yield fell to record lows. Our overweight to Short-Term High Yield paid off with some nice outperformance as well.

Going Forward:

ON EQUITIES:

1. A sector perspective on US Markets:

2. Pockets of the market have seen incredible gains over the past year and in particular Green Energy. I am not opposed to Green Energy, but I do think the prices of the aggregate securities are overdone at this point. One of our Equity overweights was to more traditional Energy via XLE which is up 41.56% year to date vs. Clean Energy ETF ICLN being down -24.21%. If ICLN were to go back to pre COVID-19 levels, it would represent a 41% drop from current prices. I think that is unlikely to occur but that an additional 20% lower from where prices are now could provide a buying opportunity which we’ll revisit the risk reward when the time comes. It is clear that the Biden Administration is looking to invest in this space aggressively though and it should provide some nice tailwinds in the future.

3. I started the year with overweights of Energies, Financials, Industrials and Healthcare. You can find all of these represented in your GA Investment Management ETF allocation portfolios and are maintaining these overweights as of writing 5/10/21.

ON FIXED INCOME:

1. The investable Aggregate Bond Index via AGG is down 3.18% through May 10th close.

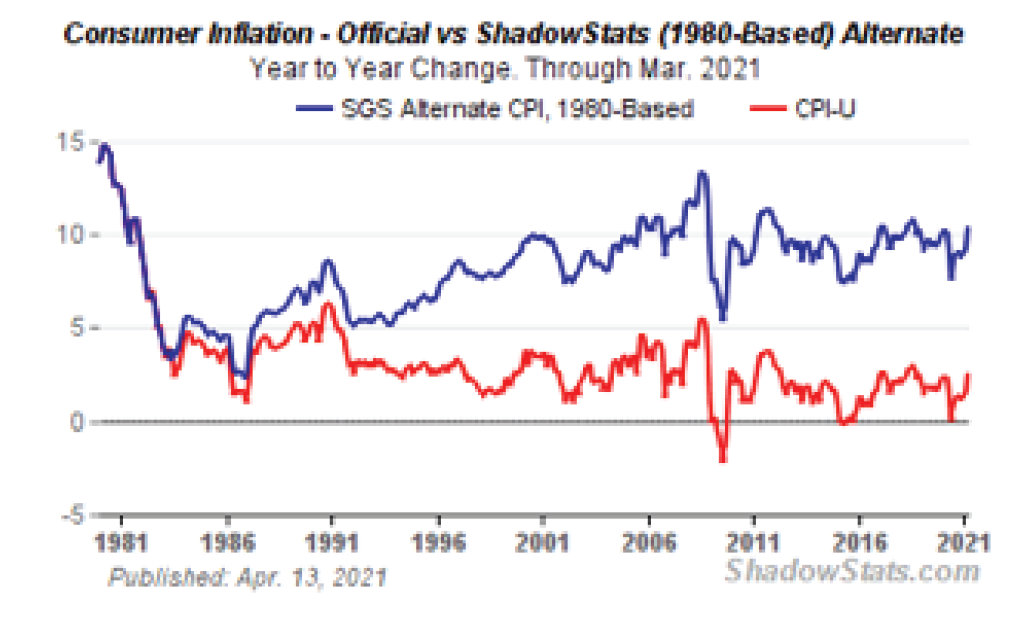

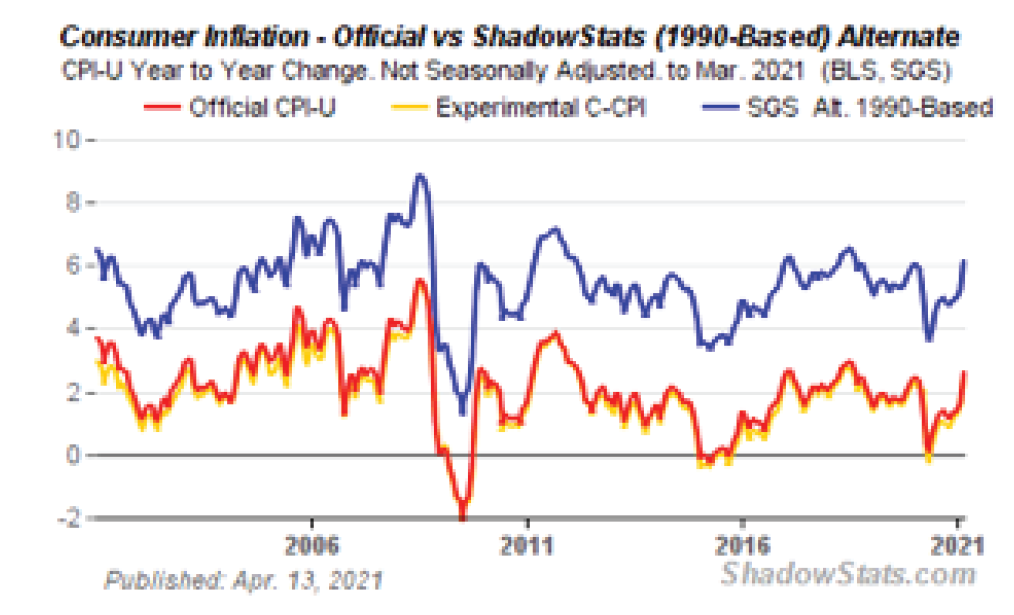

2. I still maintain conviction that Mortgages as well as Short and Intermediate Term US Corporate bonds are areas I would rather be in than in US Government Bonds or securities that are further out from a maturities perspective. I am certainly playing the long-game here and by long, I fully anticipate this being a one year plus set up. We will dip our toe in as yields normalize and come closer to a positive real rate of return but for now are going to be conservative on the Fixed Income side preferring shorter durations and higher quality for the most part aside from short-term high yield. For reference, we do not consider the current calculation of CPI to be a good measure of inflation and prefer the calculation from the 1980s and 1990s. It’s curious how revisions to the CPI calculation formula seem to consistently dampen it.

3. I also think that given global and specifically US liquidity that High-Yield Short Duration bonds are good investment. The spread between High-Yield bonds and Investment Grade bonds is within just a few hundredths of a percent of lows from 5 years ago and going back to December of 1996. At GA Investment Management, we do not want to chase yield currently with duration risk. For reference, at the depths of the COVID – 19 market meltdown in March of 2020, high yield was down 21.8%per the investable ETF JNK. It has since nearly recovered all losses and yields just 4.25% based on a 30-day extrapolation. There will come a time when I invite High-Yield Corporates with some duration into our Fixed Income portfolios, but for now, I will wait patiently on the sidelines as opposed to picking up pennies in front of the proverbial steam roller of what I think is an inevitable slow march higher in yields over the coming years. A 7% yield is an area I would consider a small position to start and or a high yield spread of around 5% or higher.

Credit to www.shadowstats.com for the below infographics:

ON THE POLITICAL AND SPENDING FRONT:

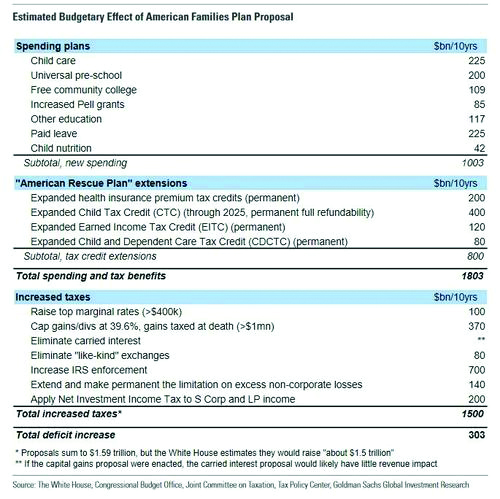

As of writing, there are two potentially impactful tax changes on the horizon which I am watching closely. One is a corporate tax rate change and the other two are potential changes in the personal capital gains rates and removal of the Step Up benefit. Both of these are in their discussion/formulation phases and I can only theoretically prepare for recommended changes to client portfolios as a result, if any.

- With respect to the Corporate rate, there are discussions taking place which would move the US Corporate Rate from 21% to 28% via a plan announced by the Treasury Department. It would also impose a 15%minimum tax on the book income of large corporations. The book income taxation piece is aimed at filling in some of the differences between financial income and taxable income for corporations.

This move could encourage companies to invest more in their businesses as opposed to paying taxes on earnings. The current proposal from the Biden administration is 28% but they have expressed willingness to negotiate. Look for them to not quite meet in the middle and chalk it up as a win with a 25% rate. - Capital gains tax changes on those making over $1m per year may also be passed. This year could be very important from a tax-planning perspective regarding highly appreciated securities as well as small business sales. Historically, tax changes have not been made retroactively however I cannot predict what will happen on this front. If I do see tax changes taking affect next year to the detriment of portfolios I will likely recommend to rebalance portfolios and bear seemingly large tax consequences in 2021 to avoid higher taxation in 2022 and beyond but again, we cannot recommend changes without knowing for sure what tax laws are actually passed. Your Financial Advisor or other professional will be able to make that recommendation when the time comes.

ON THE FED AND TREASURY:

As mentioned previously, we are full steam ahead. Jerome Powell has made it clear we are not at Grandmother’s house yet and that rates will remain low for some time. When pressed on when he would raise rates, he has said that we are not even thinking about raising rates.

He has been consistent throughout his reign and I see no reason to doubt what he has said. On the Treasury side, Janet Yellen has echoed enough concern for us to believe she is very much on the same train as Powell in terms of not wanting to risk the recovery on a policy change. It is my opinion that we are going to continue to pay for legislative spending by printing more money and therefore through inflation for years to come. This, as always, will disproportionately impact the middle class, whose budgets are made up of larger percentages of Food, Energy and Housing than those in the upper classes. Politicians out of self-preservation will not be choosing austerity in my opinion and I think more handouts are on the way.

ON THE STATE OF THE MARKET’S PSYCHOLOGY.

“You can’t lose.” “Better get in now.”

“The Fed has your back.” We have all read these headlines. Based on Margin Debt, and Fund Manager surveys revealing cash holdings near all-time lows, everyone is in the pool so to speak and why not? Interest rates are below a positive real yield, The Fed continues to buy bonds at a rate of $80 billion per month and Mortgage-Backed Securities at $40 billion per month and we are no longer in crisis mode. Most importantly though, the economy is reopening and there are headlines adorned with splashy titles like “Roaring 20’s” all over again. The “Roaring 20’s” scenario could very well play out as the Fed keeps the punchbowl topped off. The reality is that with the Fed manipulating rates, owning the productive assets and being able to invest will continue to provide an attractive risk/reward scenario for investors over the long run. I also believe that the wealth gap, will if anything accelerate. With cheap money, corporations can invest in new projects and or engage in stock buybacks to boost share prices; both of which provide benefits to investors.

Outlook going forward:

• Overweight Equities vs. Fixed Income.

• Short duration over Long.

• Quality Fixed Income over High Yield

(aside from Short-Term High Yield).

• Energy, Financials, Industrials and Healthcare to lead other sectors given the global economy continues to successfully reopen and interest rates rise.

• The velocity of money will pick up substantially towards the middle to end of Q2 increasing inflation; even by CPI’s flawed estimate.

As always, thank you for reading. It is my privilege to serve all of our clients here at GA Investment Management. I hope your personal re-opening summers are full of collective laughter and joy with Family and Friends.

– Louis Civitarese, MBA, CAIA®, CMT®

Chief Investment Officer at GA Investment Management